The Bitcoin price made a strong comeback on Friday after witnessing a significant amount of bearish pressure throughout the past week. On Wednesday, May 1, the premier cryptocurrency fell below the $60,000 mark for the first time in almost two months.

On Friday, May 3, the price of BTC recovered above the $60,000 level, going as high as $63,000 in the past day. However, the question is – can the Bitcoin price enjoy a sustained rally following this latest resurgence?

How Long Will The BTC Price Rally Last?

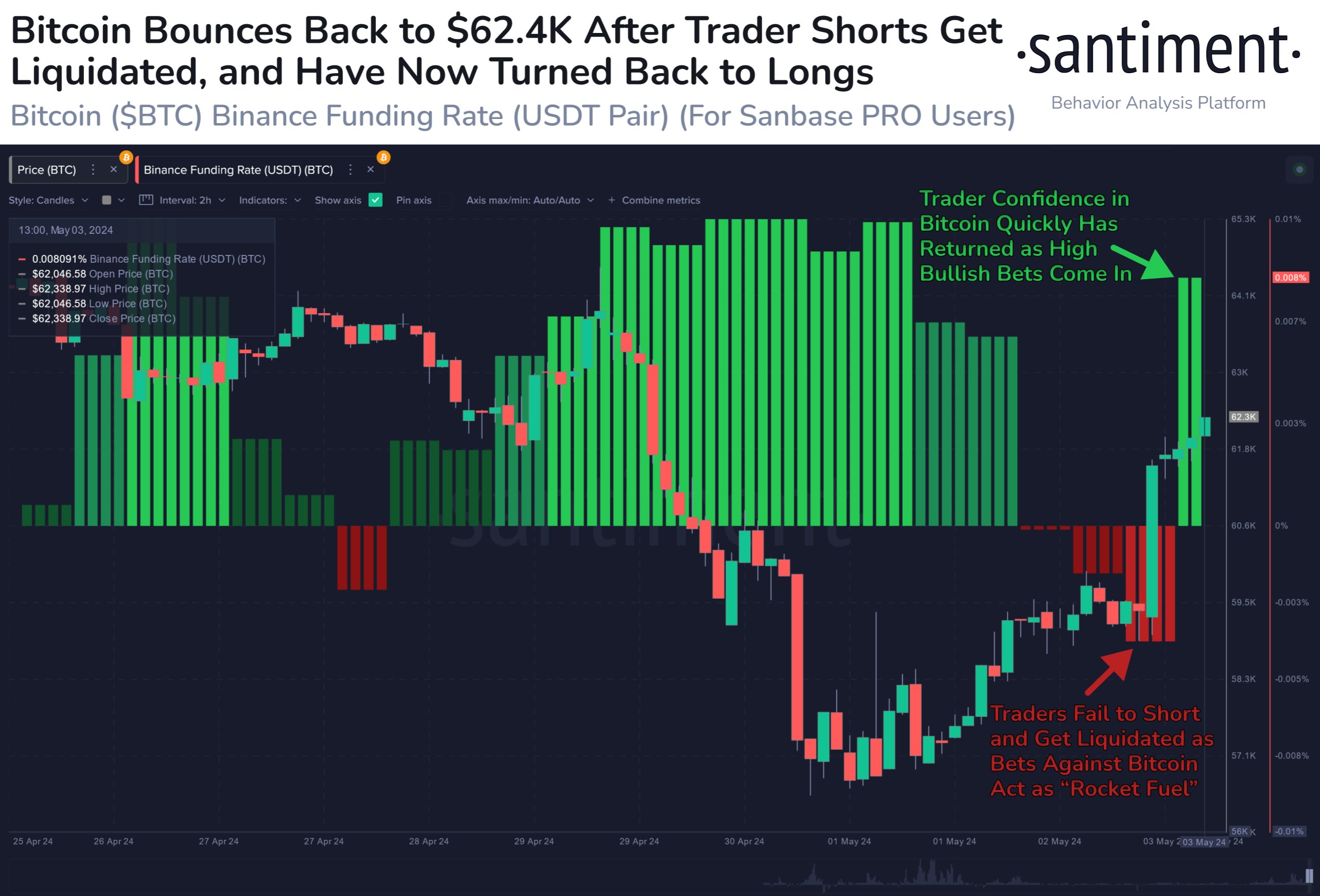

In a recent post on the X platform, Santiment pointed to a shift in investors’ position and sentiment on the Bitcoin price following the recent surge above $62,000. According to the on-chain analytics site, traders on the Binance platform are “going from liquidated shorts to longs” after the latest price increase.

While this shift in sentiment might signal renewed optimism in the premier cryptocurrency, Santiment sounded a warning bell for enthusiasts watching the Bitcoin price and looking to get into the market. The blockchain firm said in its post:

For the rally to continue, we don’t want to see FOMO rising too much higher than what it appears to be now.

Source: Santiment/X

FOMO, or “fear of missing out,” is a phenomenon where investors hastily purchase in-demand assets out of fear of missing out on potential gains. While it can drive the asset to a higher price in the short term, excessive FOMO often results in unsustainable bullish trends and subsequent downturns.

What’s more, crypto prices tend to move in the opposite direction of the crowd’s expectations. Hence, if the majority of traders are betting on the Bitcoin price to rise, there is a great likelihood that the cryptocurrency’s value will experience a drop.

Behind The Bitcoin Price Surge

As of this writing, the Bitcoin price stands at around $62,871, reflecting a substantial 6% increase in the last 24 hours. Although the catalyst for this latest Bitcoin rally remains unclear, on-chain data shows that recent whale activity might have triggered the bullish momentum.

In a recent post on X, CryptoQuant CEO and founder Ki Young Ju revealed that Bitcoin whales acquired 47,000 BTC in a single day. Ju also said that while this class of investors might have included ETF-associated addresses, the recent spike in “balances for whale addresses” is not ETF-related.

#Bitcoin whales accumulated 47K $BTC in the past 24 hours. We’re entering a new era. pic.twitter.com/SXgzToN8GU

— Ki Young Ju (@ki_young_ju) May 3, 2024

Bitcoin price fails to hold above $63,000 on the daily timeframe | Source: BTCUSDT chart from TradingView

Featured image from iStock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.