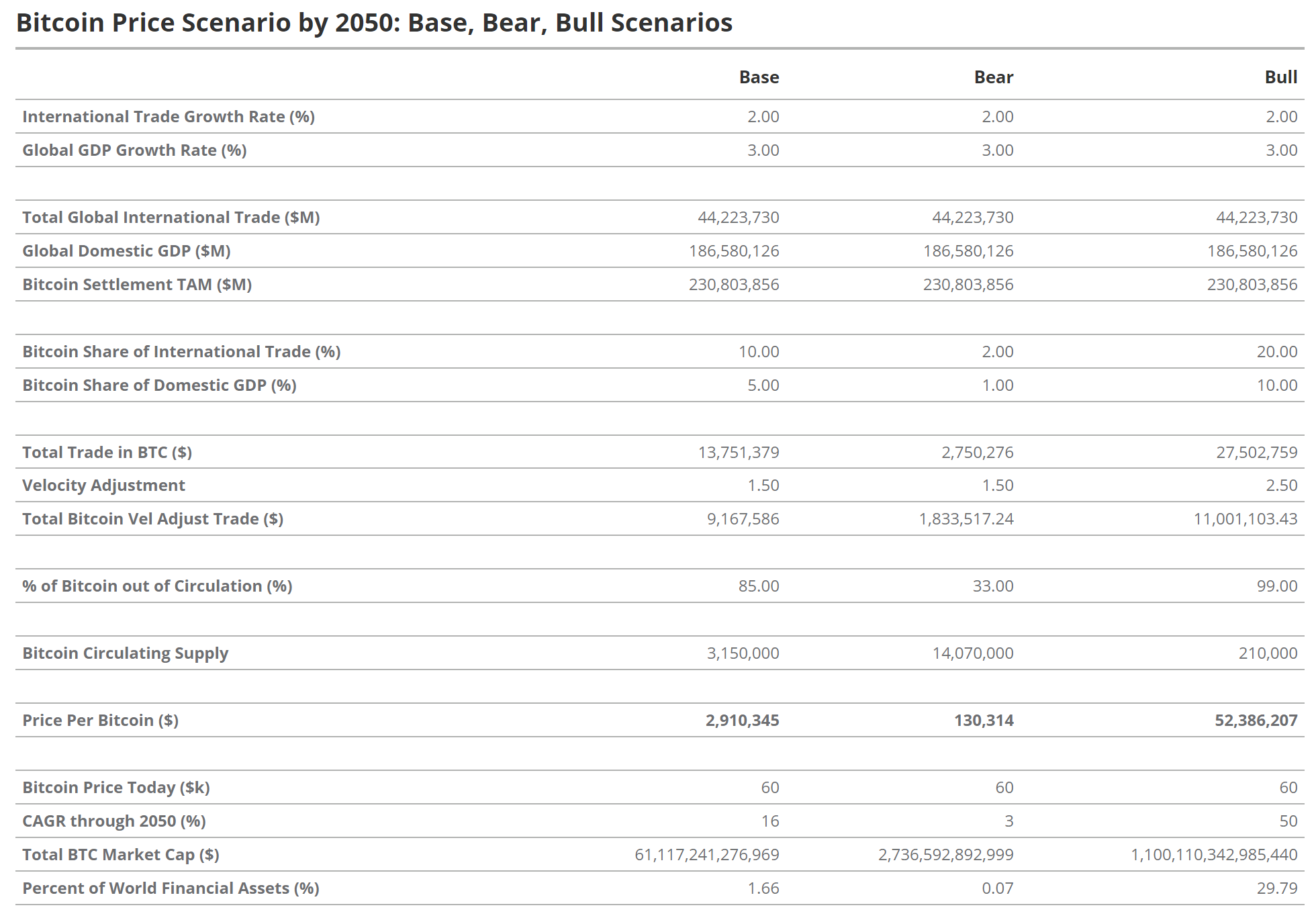

In a new report dated July 24, 2024, from VanEck, the investment firm’s digital assets research team, headed by Matthew Sigel and Patrick Bush, sets forth an exceptional prediction: Bitcoin could soar to a value of $52.38 million per coin by 2050 in their most bullish scenario. The analysis, titled “Bitcoin 2050 Valuation Scenarios: Global Medium of Exchange and Reserve Asset,” paints a picture of Bitcoin transforming into a cornerstone of the global monetary framework, functioning as both a major international medium of exchange and a reserve currency.

How Bitcoin Could Hit $52.38 Million

The report elaborates on Bitcoin’s potential trajectory, forecasting its establishment as a primary reserve currency by mid-century. “By 2050, we see bitcoin solidifying its position as a key international medium of exchange, ultimately becoming one of the world’s reserve currencies,” the researchers state. This scenario is founded on the expectation that the current trust in traditional reserve assets will erode, mainly due to the unsustainable fiscal policies and geopolitical decisions of today’s economic leaders.

Related Reading

VanEck predicts that the resolution of Bitcoin’s scalability issues through emerging Layer-2 solutions will significantly enhance its functionality, making it an attractive option in the financial systems of developing nations. “The combination of Bitcoin’s immutable property rights and sound money principles with the enhanced functionality provided by L2 solutions could enable the creation of a global financial system capable of better meeting the developing world’s needs,” Sigel and Bush argue.

Within their analysis of the International Monetary System (IMS), VanEck underscores the declining relevance of the principal currencies—USD, EUR, JPY, and GBP—in global trade. They foresee a reduction in their collective share of cross-border payments from 86% in 2023 to 64% in 2050. “This opens significant opportunities for Bitcoin to become an important alternative to settle international trade,” the report suggests.

The base case scenario envisions Bitcoin reaching a valuation of $2.9 million per coin by 2050. This prediction is anchored in the cryptocurrency’s projected role in settling a portion of global trade—10% of international and 5% of domestic trade—combined with a significant allocation as a central bank reserve.

“This scenario would result in central banks holding 2.5% of their assets in BTC, contributing to a total market cap of $61 trillion.” In this view, Bitcoin is anticipated to make up 1.66% of World Financial Assets, leveraging the anticipated growth in global trade and investment demand.

Related Reading

The bull case, however, projects The bull case scenario presented by VanEck outlines an even more optimistic outlook where Bitcoin’s integration into the global economy is profoundly more significant. The report suggests Bitcoin could facilitate 20% of global international trade and 10% of domestic trade volumes by 2050.

In this scenario Bitcoin comprises a staggering 29.79% of global financial assets. Notably, this scenario implies that nearly 99% of Bitcoin’s supply would be removed from circulation, attributed to its store of value properties, leaving only about 210,000 BTC in active circulation.

The report also highlights existing limitations in Bitcoin’s ability to function as a medium of international trade, particularly its current transaction processing capacity and lack of support for complex smart contracts. However, VanEck is optimistic about future improvements, suggesting that “ongoing development in Bitcoin’s infrastructure, particularly through Layer-2 solutions, will progressively enhance its functionality and appeal as a robust, decentralized financial system.”

Concluding the analysis, VanEck envisions Bitcoin not merely as a financial tool but as a transformative economic force that redefines money in a global context. “Bitcoin applies constitutional constraints to money, representing a system created by the people, for the people, and might serve as the ultimate check against the often arbitrary financial powers of the state,” the report reflects.

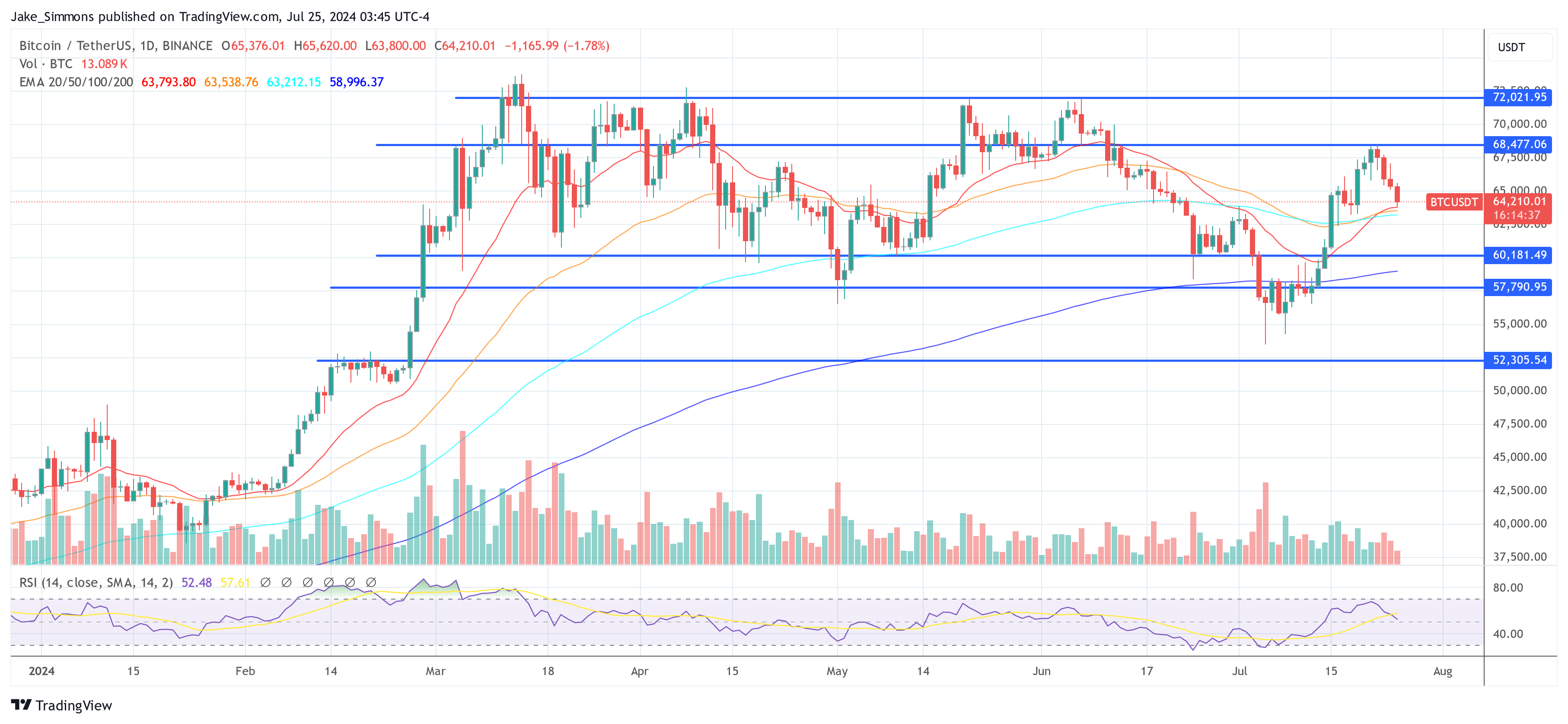

At press time, BTC traded at $64,210.

Featured image created with DALL·E, chart from TradingView.com