Learn which two megacap stocks are worth considering.

There are lots of ways to make money in the stock market.

One way, favored by money managers going back centuries, is to look for businesses that lack something — namely, competitors.

And while it’s difficult to find pure monopolies (for an obvious reason, they’re typically illegal), investors can often locate companies that have carved out a significant niche — sometimes a very large niche.

So today, let’s look at two companies that have found large and profitable niches.

Image source: Getty Images.

Meta Platforms

First up is Meta Platforms (META 2.28%). With a stock price of $462 at the time of this writing, a person with $1,000 to invest could allocate roughly half of their money to purchase one share of Meta Platforms.

Here’s why that seems like a smart move to me. The company operates the largest social media network around, and because of that, it generates a ton of revenue, profit, and free cash flow.

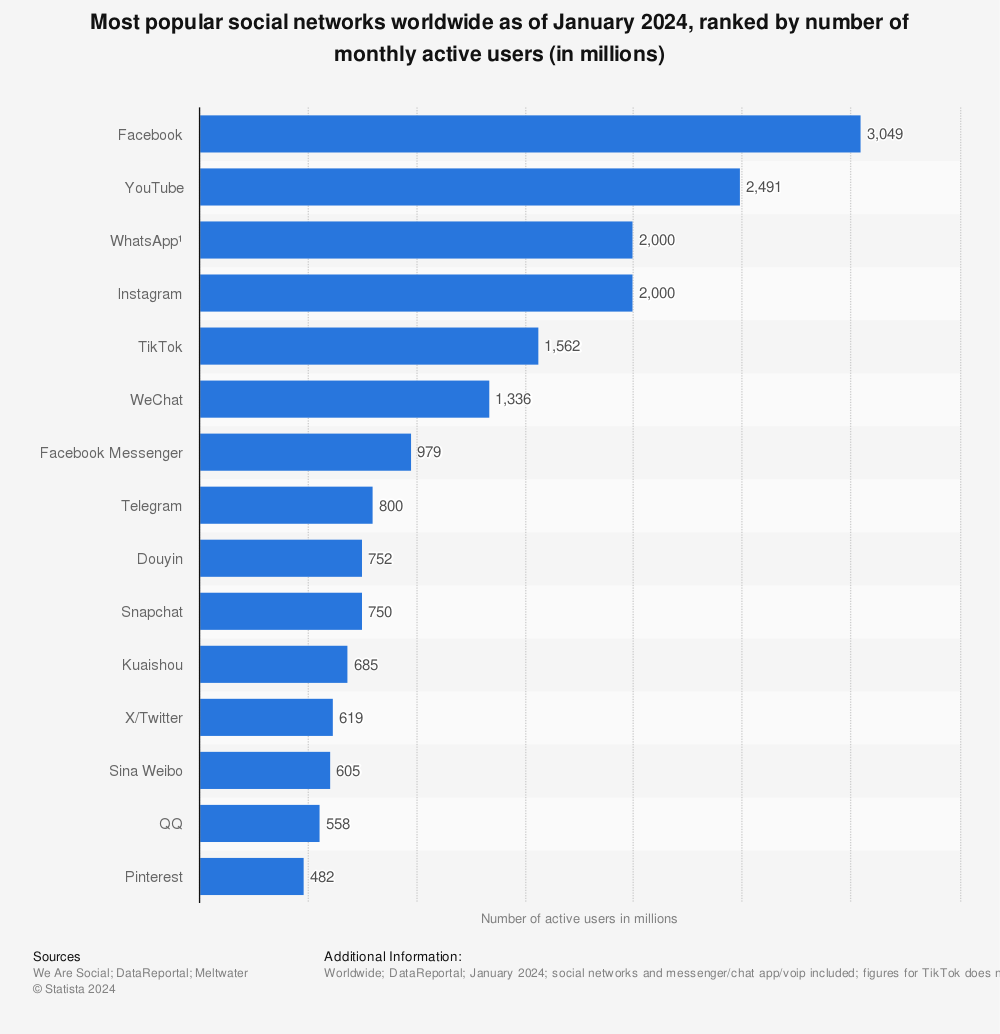

The company’s platforms include Facebook, Instagram, WhatsApp, and Facebook Messenger. Each of these platforms has over 1 billion monthly active users (MAUs); Facebook alone has over 3 billion.

Image source: Statista

With so many active users, Meta can sell targeted advertising to marketers around the world. And that ad revenue really piles up.

In its most recent quarter (the three months ending March 31, 2024), Meta recorded $36.5 billion in revenue — nearly all of it coming from advertising.

To sum up, Meta’s large share of the social media market (and the associated digital advertising market) have turned the company into a real cash cow — making it a smart choice for those looking to put money to work in the stock market.

Microsoft

The second stock that investors with $1,000 should consider is Microsoft (MSFT -0.39%). As of this writing, a single share of Microsoft costs $412. Yet that might be a bargain, given Microsoft’s immense assets.

Let’s start with the obvious: Microsoft is the world’s largest company, with a market cap over $3 trillion. The company has several business segments, ranging from gaming to cloud computing to personal and business software. In addition, the company’s advertising segment is a hidden jewel and generates about $12 billion in annual revenue.

Image source: The Motley Fool.

Moreover, Microsoft is on the cutting edge of today’s most exciting technological development: artificial intelligence (AI). Microsoft has leveraged its long-standing partnership with ChatGPT-maker OpenAI to bring new AI-powered features to its legendary software suite. In addition, the company has monetized those features, selling them as a software add-on in exchange for a monthly fee.

While Microsoft does have competitors, only a few can match the company’s enormous size — and even fewer can compete in every realm. In short, Microsoft remains a juggernaut that investors should consider when looking to put money to work in the stock market.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jake Lerch has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.