Learn what trend is sweeping the U.S. and what stock is poised to capitalize on it.

Trends can be easy to miss. After all, many people heard about artificial intelligence (AI) and how it was the “next big thing,” and yet, many of those same people never invested a penny into AI stocks like Nvidia, Super Micro Computer, or SoundHound AI before they went parabolic during the last two years.

So, what other trends — and potential multibaggers — might investors be missing?

I think I’ve identified one such trend. I don’t think it will be as big or important as AI, but it could still make savvy investors happier and richer in the process. The trend is sports betting, and the stock is DraftKings (DKNG 0.63%). Here’s what you need to know.

Image source: Getty Images.

Why is sports betting taking off?

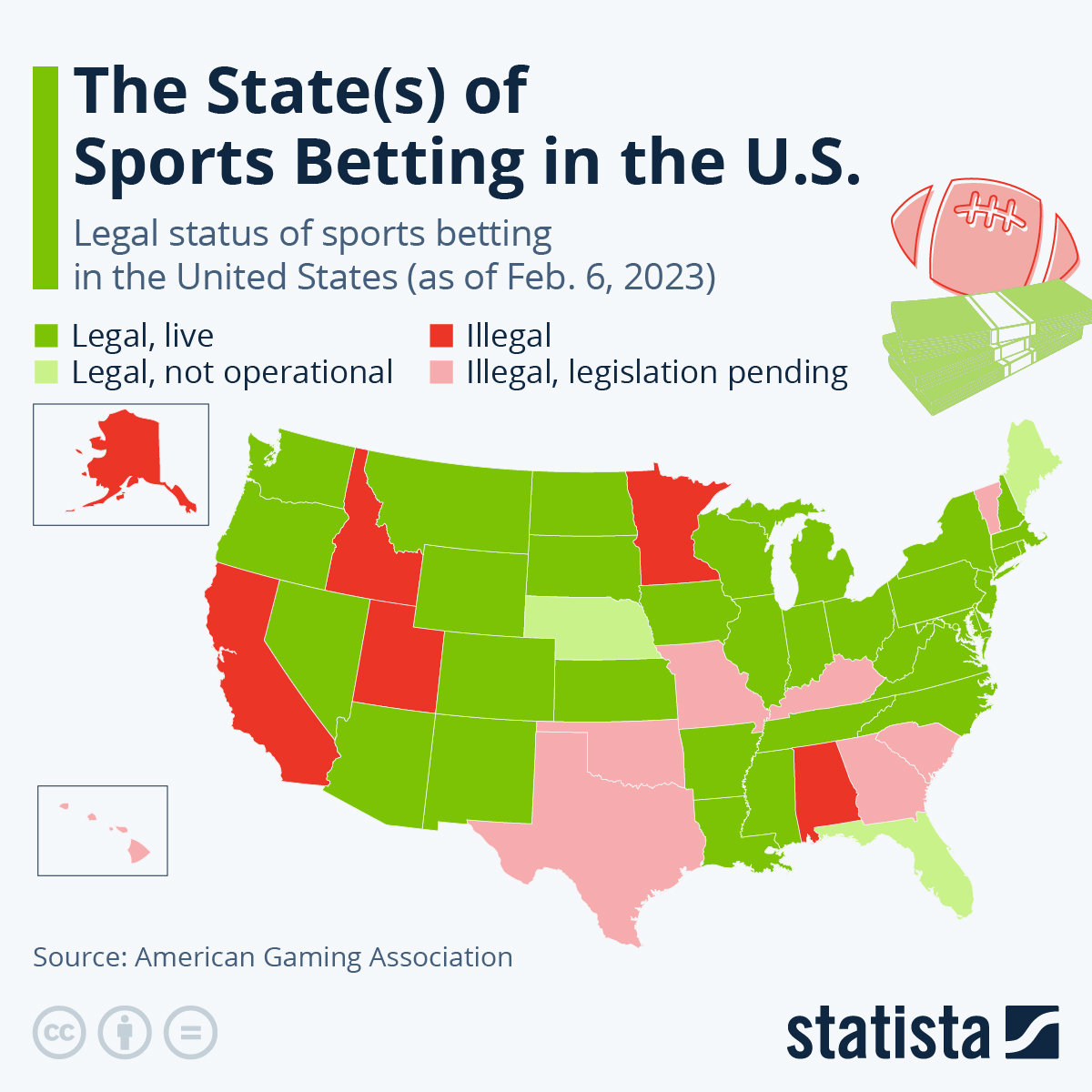

First things first: In 2018, the U.S. Supreme Court struck down a federal ban on sports betting. Since then, dozens of states have passed state laws permitting some form of sports wagering. As of this writing, 38 states and the District of Columbia now permit gambling on sports. In terms of population, well over 200 million Americans can now place legal sports bets in their home state.

You will find more infographics at Statista

That means the number of potential bettors — customers for sportsbooks like DraftKings — has soared more than 10x over the last six years. That said, the growth isn’t over — not by a long shot.

Of the 12 states where sports betting remains illegal, three states (California, Texas, and Georgia) rank among the top 10 in overall population.

In other words, there are still well over 80 million Americans who cannot legally place a sports bet in their home state. Californians voted down sports betting in 2022. Texas is unlikely to pass any legislation until 2025, and Georgia lawmakers failed to pass legislation legalizing sports betting this spring.

At any rate, the sports betting market is still growing at a rapid pace. According to the American Gaming Association, gaming revenue derived from sports betting has increased from $0.9 billion in 2019 to over $10.9 billion in 2023. In other words, the growth is rapid, and there remain plenty of untapped markets.

You will find more infographics at Statista

Why is DraftKings positioned to capitalize on the trend?

In the years before the 2018 Supreme Court ruling, hundreds of millions of Americans scratched the itch of sports betting through “fantasy” sports. These games allowed customers to pick “teams” of their favorite players and win cash based on how their players performed. It wasn’t direct gambling on sports — but it was close.

And what company was at the forefront of the fantasy sports craze? You guessed it: DraftKings.

The company was — and remains — one of the leading fantasy sports platforms. Now, with the company transforming into a full-fledged sportsbook, it can use its relationship with fantasy players to convert them into sports bettors.

As of its most recent quarter (the three months ending on Dec. 31, 2023), the company reported 7.1 million unique customers, up 37% from a year earlier. Revenue generated over the last 12 months was $3.7 billion, with quarterly revenue growing 44% year over year.

All this said, Draftkings is not a stock for every investor. For one thing, the company is squarely in its early life cycle. It pays no dividends; it is unprofitable right now. That means it is poorly suited for income-seeking investors.

For another thing, its business is gambling. That makes it a “sin stock,” meaning many investors will want to steer clear of it on moral grounds.

Nevertheless, for many other investors, DraftKings is a stock worth considering. It is benefiting from a fast-growing market that should continue to expand for many years to come. So, for those open to owning shares in a gaming company, DraftKings is a name to remember.