The much-anticipated launch of several Ethereum-based spot exchange-traded funds (ETFs) failed to ignite a significant Ethereum (ETH) price rally. Despite considerable trading volumes and large inflows for the “newborn” ETFs on their first day, the Grayscale outflows have been too massive (once again) to propel the Ether price upwards.

Ethereum ETFs Start Strong, But Grayscale …

Eric Balchunas, a senior ETF analyst at Bloomberg, shared via X (formerly Twitter), “DAY ONE in the books for Eth ETFs who did $1b in total volume, which is 23% of what the spot bitcoin ETFs did on their first day and ETHA did 25% of IBIT’s volume.” He also noted that “The gap between ETHE and The Newborn Eight is a healthy +$625m.”

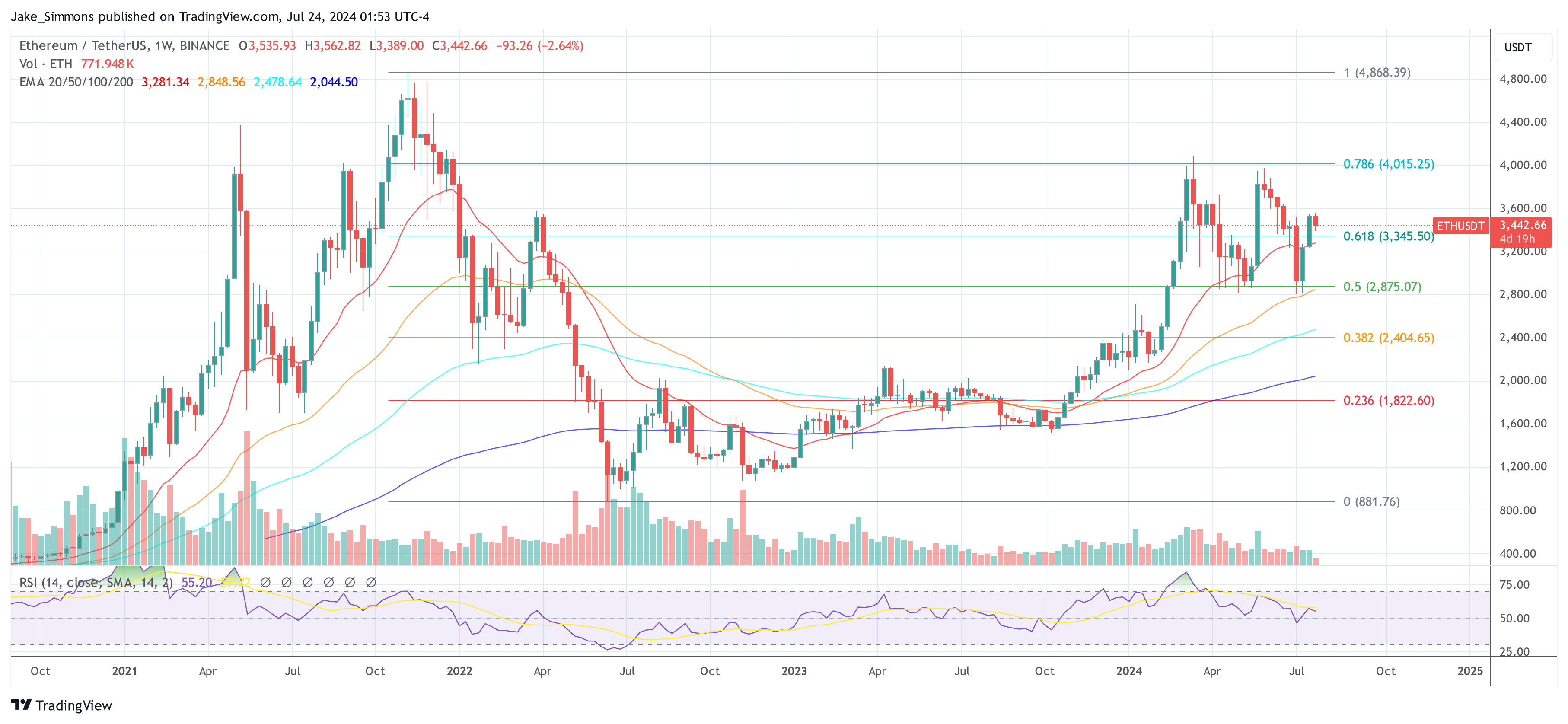

However, despite these healthy volumes, the price of Ethereum only increased marginally by 1% yesterday. At press time, ETH stood at $3,437, down 0.4% over the past 24 hours. In contrast, Bitcoin (BTC) price declined by 1.6%, and other altcoins also faced downward pressure, dropping between 4% and 10%.

Related Reading

James Seyffart, another Bloomberg ETF expert, commented the first day of inflows, “First full day of flows for the ETHness stakes are in. The Ethereum ETFs took in $107 million. BlackRock’s ETHA led the way with $266.5 million followed by Bitwise’s ETHW with $204 million. Very solid first day.”

Despite these positive inflows, the day was not without its challenges. The Grayscale Ethereum Trust (ETHE), which transitioned from a traditional trust to a spot ETF, saw substantial outflows amounting to $484.9 million, representing about 5% of the fund’s value. Eric Balchunas commented on this movement, “Damn. That’s a lot. Like 5% of the fund. Not sure The Eight newbies can offset w inflows at this magnitude. On flip side maybe its for best to just get it over with fast, like ripping a band aid off.”

The introduction of these ETFs is part of a broader trend following the launch of similar Bitcoin ETFs in January, which also experienced a mix of inflows and significant outflows from the Grayscale Bitcoin Trust (GBTC). The Ethereum Mini Trust, another Grayscale product, however, reported $15.2 million in new inflows.

Related Reading

Other notable Ethereum ETFs like Franklin Templeton’s (EZET) and 21Shares’ Core Ethereum ETF (CETH) saw inflows of $13.2 million and $7.4 million, respectively, indicating varying levels of investor interest across different funds.

Overall, the first day of trading for these Ethereum ETFs brought in significant volumes and a complex flow of funds but did not translate into a significant price rally for Ethereum. As with Bitcoin, the Grayscale outflows for Ethereum seem to need to be cleared out of the way before the ETFs could have a significant impact on the price.

At press time, ETH traded at $3,442.

Featured image created with DALL·E, chart from TradingView.com