Bitcoin is trading for $59,545, a slight increase of 0.5% in the past 24 hours. Although little, this surge in its price is quite noteworthy as it comes against the backdrop of Bitcoin’s price plunging as low as $57,812 earlier today.

Regardless of this modest recovery, a recent analysis by a CryptoQuant author on the CryptoQuant QuickTake platform has revealed that Bitcoin might now be approaching a precarious position.

Bears At The Gates? Analyzing BTC’s Vulnerable Stance

According to the CryptoQuant analyst Grizzly, Bitcoin’s Net Unrealized Profit/Loss (NUPL) metric—a tool used to gauge the market’s profit or loss status by comparing unrealized profit and loss—hovers near a pivotal threshold—0.4 level.

Grizzly disclosed that this level historically acts as a vital juncture, either as support that boosts the market’s spirits or as a resistance that spells a downturn.

Will the bears seize control of the market?

“The NUPL metric is currently positioned near a critical level. Historically, the 0.4 level has served as a significant point of support and resistance.” – By @GrizzlyBTClover

Read more

pic.twitter.com/sePvAvWg44

— CryptoQuant.com (@cryptoquant_com) August 15, 2024

Current data suggests that Bitcoin is teetering close to this level, and a dip below could firmly hand the reins over to the bears, potentially dragging the market into a bearish phase.

According to Grizzly, the implications of such a move could see Bitcoin’s price retract to as low as $40,000, a major decline from its current market prices. The analyst particularly noted:

Data shows that a breach below this [0.4] level often marks the onset of a substantial downward trend. If the index continues its downward movement, it’s reasonable to anticipate that the bears could take full control of the market. In such a scenario, the price could drop to around $40,000.

Meanwhile, despite these ominous signs, it’s worth approaching the revealed data with a balanced perspective. Grizzly pointed out that the current decline in Bitcoin’s value while concerning, has not yet escalated to a level that conclusively signals the end of its bullish trajectory.

Historical data supports cautious optimism, as previous instances have shown that Bitcoin can rebound from similar positions, defying bearish expectations and sustaining its upward trend.

Bullish Take On Bitcoin

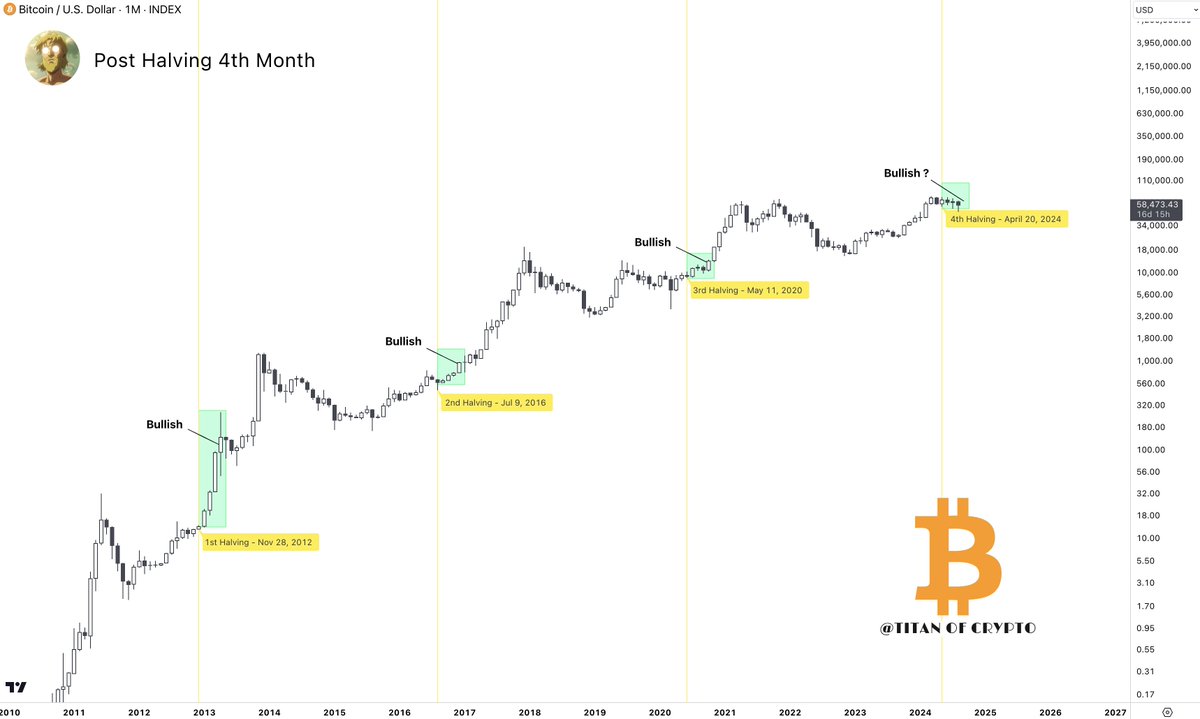

On the flip side, historical data may also suggest a potential rebound for Bitcoin. Earlier today, a renowned analyst in the crypto space known as Titan of Crypto on X disclosed an interesting recurring trend in Bitcoin.

According to Titan of Crypto, “historically, the 4th month after the halving has always been bullish for BTC, closing above the halving price.” The analyst added: “If this pattern repeats, September could be a bullish month above $66,000.”

Featured image created with DALL-E, Chart from TradingView