Este artículo también está disponible en español.

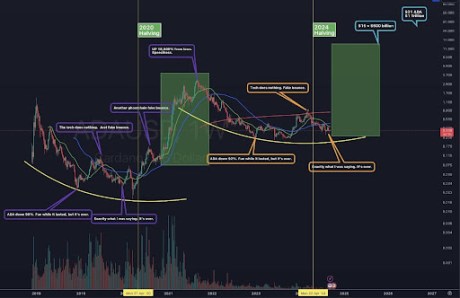

Since March, Cardano (ADA) has experienced recurring periods of significant price declines. However, crypto pundit Dan Gambardello, a popular analyst on the Crypto Capital Venture’s YouTube channel, predicts a potential bullish reversal based on an analysis of the weekly and daily charts.

Key Technical Indicators Support Bullish Outlook

According to the analyst in a recent video, ADA is poised for a significant breakout, potentially reaching around $31, representing a remarkable 8,500% increase from current levels. The analyst highlighted that the market has experienced “180 days of downside” since March, creating favorable conditions for this anticipated surge.

Related Reading

He further suggested that ADA could break its current cycle of lower highs and lower lows, citing key technical indicators, particularly the MACD (Moving Average Convergence Divergence) on the weekly chart, which is showing signs of a bullish crossover. “The macro momentum of Cardano is signaling its readiness to bottom,” he said, emphasizing the upward momentum of the MACD histogram since May.

However, he cautioned that ADA has yet to decisively move above the 20-day and 50-day moving averages. He warned that while testing key levels, the move could fail, advising patience until more price action confirms a true breakout. While some analysts view Dan Gamberdello projections as overly optimistic, crypto analyst Sssebi has offered a more conservative forecast.

He forecasts a rally of 20x to 30x for Cardano over the next year. Sssebi noted that Cardano current position mirrors its state during the last cycle, indicating a major rally may be imminent. He predicts that Cardano could hit a minimum price of $5 by 2025, with a possible peak of $10 during the height of the bull market.

Cautious Outlook For Cardano

However, not all analysts are as bullish. Trader “Lingrid” has adopted a more cautious perspective regarding Cardano (ADA), predicting a short-term pullback for the cryptocurrency. In a recent post, he noted that “ADAUSDT appears bearish on the daily timeframe,” forecasting a potential decline to $0.325 and suggesting that ADA may remain within the consolidation zone between $0.30 and $0.34 for an extended period.

Related Reading

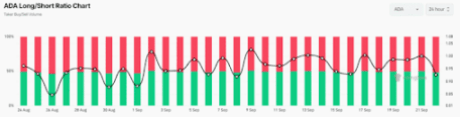

This negative outlook is further reinforced by the bearish on-chain metric. According to Coinglass, ADA’s Long/Short ratio currently stands at 0.926, indicating a prevailing bearish sentiment among traders.

Furthermore, its future open interest has declined by 3.8% in the last 24 hours and has been steadily falling. This suggests that traders are either liquidating their positions or hesitant to establish new ones.

At press time, ADA was trading near the $0.352 level and had experienced a modest price decline of 0.8% in the last 24 hours. During the same period, its trading volume had dropped by 18%, indicating lower participation from traders amid selling pressure.

Featured image created with Dall.E, chart from Tradingview.com