Crypto analyst Doctor Magic (@Doctor_Magic_) has outlined three reasons for investors to consider buying XRP now. In a series of posts on the X, Doctor Magic detailed the dynamics and data points positioning XRP as a potentially lucrative investment in the current state of the market.

#1 Relative Strength Of XRP

The crypto analyst highlights the XRP price relative to Bitcoin (BTC) and its resilience in the broader market. “XRP’s strength against BTC and across the board is notable and should not be ignored at this point. When markets turn up again (soon) the pump on XRP will be violent!”

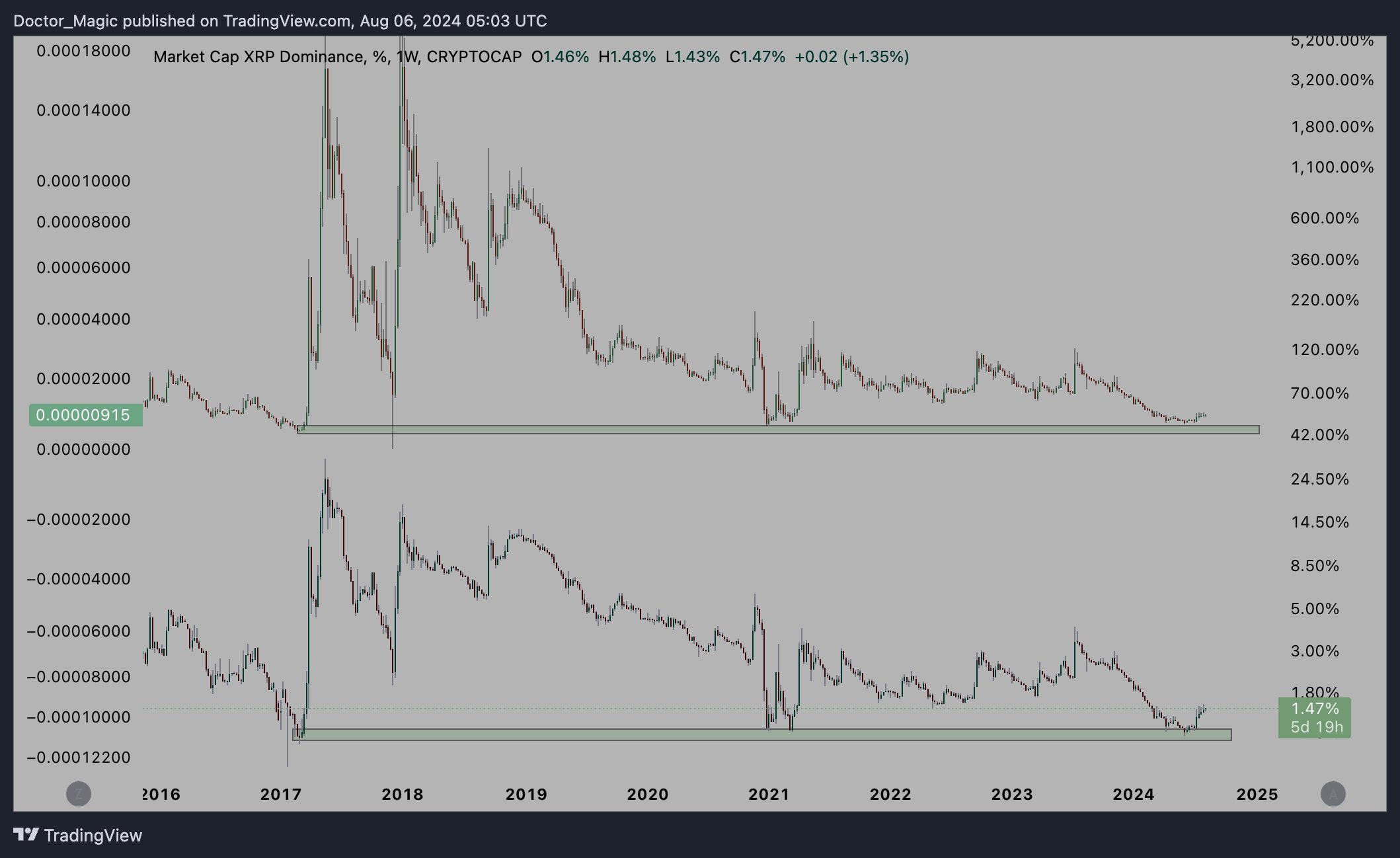

This analysis is based on a chart that plots the market cap dominance of as a ratio against BTC and the entire crypto market on a weekly timeframe. The dominance percentage is a critical metric, serving as an indicator of market capitalization relative to BTC, and thus reflects relative investment flows and market preferences.

From 2016 to 2021, XRP’s dominance displayed a significant downward trend, suggesting a period during which market preference leaned heavily towards Bitcoin. However, beginning in 2022, this trend leveled off, indicating a potential stabilization or bottoming relative to Bitcoin. This phase suggests that XRP may have found a floor in terms of its market cap dominance, setting the stage for a possible reversal.

Related Reading

A key support level for XRP/BTC is identified at 0.00000750 by the analyst. This level has been tested multiple times without a decisive break, establishing it as a critical floor where market sentiment has consistently supported the price relative to BTC. In 2024, following a bounce off this support area, there was a noticeable increase in dominance, suggesting growing investor confidence in its potential for a recovery.

In terms of dominance over the entire crypto market (XRP.D), the metric currently stands at 1.47%. After touching down in the support zone ranging from 1.02% to 1.05%, XRP.D also experienced an uptick, further underscoring the renewed market interest and potential bullish sentiment.

#2 Recovery Post-Dump With Stable Open Interest

Doctor Magic also highlights a notable aspect of the market behavior — its swift recovery from yesterday’s price crash without any increase in open interest (OI). “XRP has now retraced the whole yesterday dump with zero OI added. ZERO. And negative funding,” remarked Doctor Magic.

Related Reading

This recovery pattern is significant as it implies the rebound was not fueled by a surge in speculative trading or new positions being opened, but rather by solid buying interest, likely from investors confident in fundamentals or long-term potential.

#3 Support From Historical Open Interest Level

Finally, the crypto analyst points to the current levels of Open Interest (OI) for XRP, which aligns with a historical baseline that has consistently marked significant market tops and bottoms over the past four years. “OI on XRP at the baseline [blue line] that has marked every top and every bottom the last 4 years,” Doctor Magic notes.

This observation suggests that current OI levels are at a critical juncture, indicative of potential turning points in the market. Historically, when OI reaches these levels, it has preceded major price movements.

At press time, XRP traded at $0.5030.

Featured image created with DALL.E, chart from TradingView.com