Video streaming providers have a big churn problem. While many streaming companies are not profitable yet, the entire industry is grappling with high and fast cancellation rates.

Users who sign up for streaming services only to cancel a few months later, likely because they watched what they wanted to already or are trying to save money, has created huge churn concerns for streaming companies. Those companies are largely responding with packages that bundle their services with other services, including rival streaming platforms. But with streaming subscribers already pushed to their financial limits, it’s time for streaming providers to earn their keep, not piggyback on others.

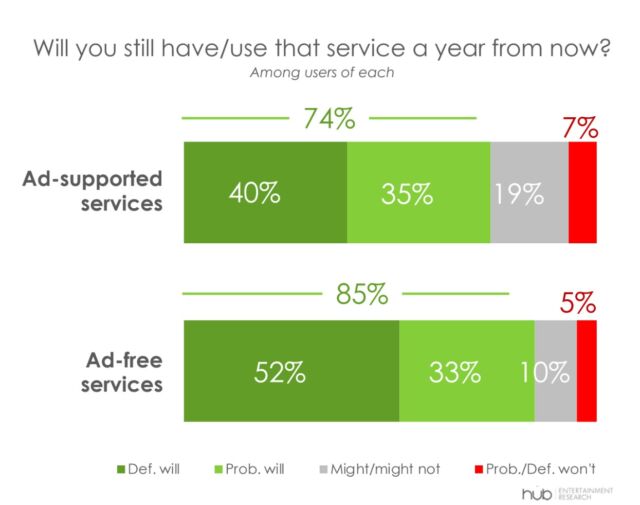

This week, media research firm Hub Entertainment Research published its 2024 Monetization of Video report with findings from June interviews of 1,600 TV viewers ages 16 to 74. The respondents reportedly each watch at least one hour of TV weekly, and the sample is “US census balanced,” per Hub. When Hub asked respondents if they will “still have/use” their video streaming services a year from now, 85 percent of those using ad-free services said they definitely or probably will, compared to 74 percent of subscribers of streaming services with ads. Further suggesting that ad-free subscription tiers garner more loyalty, 15 percent of ad-free subscribers said they “might/might not” or “probably/definitely won’t” have their subscription next year versus 26 percent of ad subscribers.

Hub Entertainment Research

“Those paying extra for ad-free services say they are more likely to keep that service than cheaper ad-supported plans,” the report says. “The act of paying more potentially increases perceived loyalty to that expense.”

Streaming providers charge less for subscriptions that show commercials because they’re able to make up the lost revenue through ad sales. Streaming firms like Netflix say they get higher monthly average revenue per user (ARPU) from ad subscribers than those who pay more for commercial-free plans. Despite the lower prices, Hub’s research found that 25 percent of respondents associate “excellent” value with paid streaming video on demand (SVOD) services with ads compared to 22 percent who think the same of SVOD without ads.

Churn troubles

Hub’s report also highlighted high streaming cancellation rates, noting that 50 percent of respondents “sign up, cancel, then re-subscribe to the same service.” Earlier this month Ampere Analysis also detailed high churn rates, saying that 42 percent of US streaming subscribers “regularly subscribe, cancel, and resubscribe” (Ampere said it examined “anonymized subscription receipt data from a panel of 3 million opted-in US email users” between February and March 2024 for its survey).

“As the SVOD market in the US has become increasingly saturated, new subscribers are harder to find, which makes retention all the more important,” said Daniel Monaghan, research manager at Ampere Analysis, said in a statement accompanying the findings.

Streaming providers have largely adopted bundling to combat high cancellation rates, with the idea being that people are less likely to pull the plug on one service if it’s tied to others. In Hub’s report, 37 percent of respondents said they’re “less likely to cancel and then resubscribe to a bundle of multiple services compared to an individual service.”

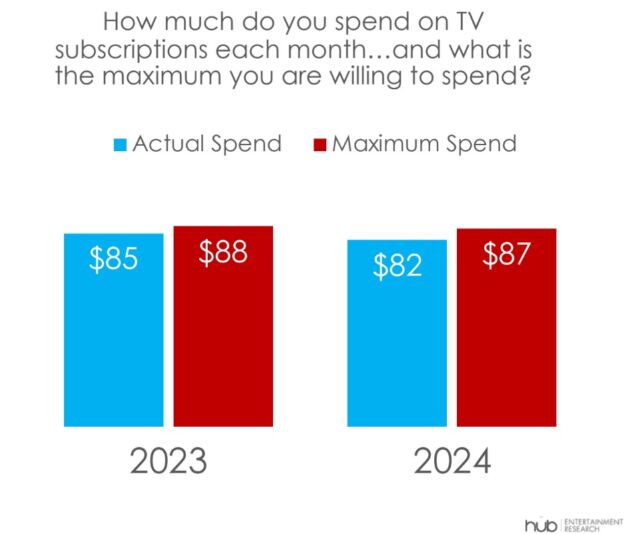

Bundles also carry price savings, a key driver for streaming subscriptions. Per Hub’s report and following a slew of streaming price hikes, people are approaching the limit of what they’re willing to spend on streaming subscriptions:

Hub Entertainment Research

But streaming services could better prove their value if they went beyond pricing and tried building loyalty through improved selection and features.