The package delivery giant expects its profit to increase dramatically as 2024 progresses

For UPS (UPS -3.06%) shareholders and potential investors, the year 2024 is poised to be a tale of two halves. While the first half is likely to show evidence of a profit decline, the second half promises a significant upswing.

This potential for high returns in the latter part of the year should inspire optimism in those two investing cohorts about UPS’ future as a stock.

UPS is on a wild ride in 2024

Here’s a summary of management’s guidance for the full year. As the table illustrates, there’s likely to be a massive shift in year-over-year profit growth in the second half. Several factors contribute to this change, and I’ll run through the main ones below.

|

UPS Guidance |

First Half 2024 |

Second Half 2024 |

Full Year 2024 |

|---|---|---|---|

|

Revenue |

Down 1% to 2% |

Up 4% to 8% |

$92 billion to $94.5 billion |

|

Adjusted operating profit |

Down 20% to 30% |

Up 20% to 30% |

$9.2 billion to $10 billion |

Data source: UPS presentations.

First, it’s important to understand why UPS had such a challenging 2023. In a nutshell, a slowing economy caused delivery volumes to be lower than management anticipated. In addition, protracted labor negotiations and the concern over a potential strike caused some customers to divert volumes to other networks. The ultimate settlement (a new contract) raised labor costs that made it difficult to reduce overall costs even as revenue declined.

Cost comparisons will get easier

The excellent news is that the transportation company will lap the cost increase from the new contract in the second half, causing costs to fall as a share of revenue. The chart below shows how revenue changed (declined heavily) year over year, but compensation and benefits did not change.

Data source: UPS presentations.

This trend is illustrated in the chart below, which depicts compensation and benefits as a percentage of revenue. Compensation costs increased noticeably in the third quarter of 2023. However, once UPS begins surpassing those costs in the third quarter of 2024, the comparisons will be much more favorable.

Data source: UPS presentations, chart by author.

In addition, UPS announced it will cut 12,000 jobs in 2024, generating $1 billion in cost savings. CEO Carol Tome and former CFO Brian Newman discussed the matter on an earnings call in January. Newman noted that 75% of the job cuts would come in the first half, but the cost benefits “will be back-end weighted.”

Tome added, “So, it’s $1 billion of cost out now, but there’s even more cost out to come as we have a full-year benefit in 2025.” As such, UPS will experience significant downward pressure on costs in the second half of 2024 and through 2025.

Delivery volumes will recover

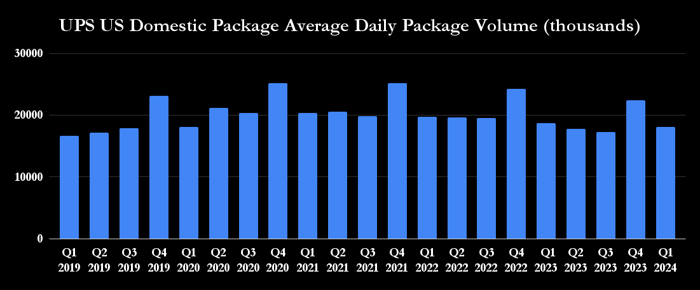

UPS management also expects better news on delivery volumes in the second half, which will feed into the 4% to 8% revenue increase it expects compared to the second half of 2023. Its U.S. domestic package average daily volume growth may have already turned positive at the time of writing.

Data source: UPS presentations.

For reference, the U.S. domestic package declined 3.2% in the first quarter, but Tome noted, “the rate of decline slowed as the quarter progressed, ending with March down less than 1%.” Newman went on to outline, “We’re expecting Q2 to be slightly positive” in terms of average daily volume in the U.S. domestic package segment in the second quarter on a year-over-year basis.

Incidentally, that figure is a crucial benchmark to monitor when UPS releases its second-quarter earnings report. Ultimately, Newman said he expects a low single-digit decline in U.S. domestic volumes in the first half to turn into a low single-digit increase in the second half.

UPS will have a better second half

Volumes are increasing, revenue is growing, and cost comparisons are easing. These tailwinds reverse the headwinds facing the company in the first half, and UPS will end the year looking much stronger than it did at the start of it.

Furthermore, as it enters 2025 and beyond, management’s focus on key end markets like healthcare and small and medium-sized businesses (SMB) should lead to revenue growth and margin expansion, while investments in automation and smart facilities should increase productivity.

All of these positive trends should begin in the second half for UPS, and the company looks set for a strong recovery — just keep an eye out for management’s commentary on the volume growth in the second quarter earnings report.